Business Insurance in and around Wilkes Barre

Calling all small business owners of Wilkes Barre!

Helping insure small businesses since 1935

Help Prepare Your Business For The Unexpected.

You've put a lot of elbow grease into your small business. At State Farm, we recognize your efforts and want to help insure you and your business, whether it's a toy store, an art gallery, a lawn care service, or other.

Calling all small business owners of Wilkes Barre!

Helping insure small businesses since 1935

Customizable Coverage For Your Business

When one is as driven about their small business as you are, it is understandable to want to make sure all bases are covered. That's why State Farm has coverage options for worker’s compensation, commercial auto, surety and fidelity bonds, and more.

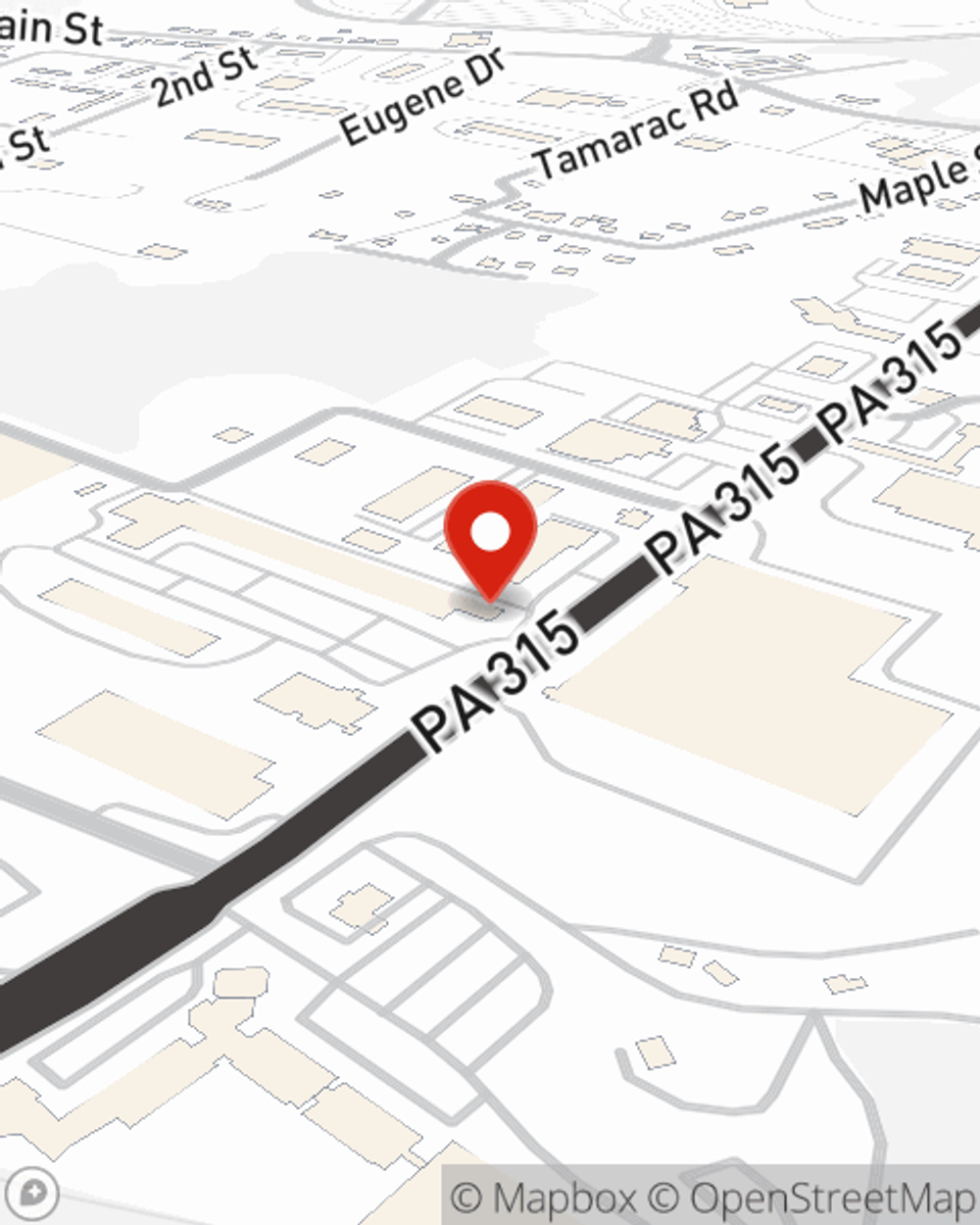

The right coverages can help keep your business safe. Consider stopping by State Farm agent Jennifer West's office today to discuss your options and get started!

Simple Insights®

Steps to start a small business

Steps to start a small business

Starting a small business can be exciting and challenging. Use this guide to help turn your idea into a successful business.

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.

Jennifer West

State Farm® Insurance AgentSimple Insights®

Steps to start a small business

Steps to start a small business

Starting a small business can be exciting and challenging. Use this guide to help turn your idea into a successful business.

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.